Series LLC vs Professional LLC, Alabama: Which One Fits Your Business?

Do you own a business in Alabama? Are you trying to pick between a Series LLC and a Professional LLC? You are not the only one!

Every year, thousands of shop owners, house renters, doctors, and lawyers ask the same thing. Pick the right one, and you save lots of money. Your stuff stays safe. Life gets easy.

Pick the wrong one, and you get big trouble with the state. You might lose your protection.

This 2025 guide uses super-easy words. We tell you exactly what each one is. We show who can use them (and who cannot). We give real prices and simple steps. By the end, you will know the best choice for you!

What Is a Series LLC in Alabama and Who Is It Really For?

A Series LLC in Alabama is a super-smart kind of company.

It is one big company with many little companies inside it. We call the little companies “series.”

Each series can:

- own its own house

- run its own shop

- has its own money

If someone sues one series (like Apartment 3), they usually can’t take stuff from the other series (like Apartment 7) or from the big main company. It’s like many safe boxes inside one big safe box!

Best fit for:

- Real estate investors who own multiple rental properties

- Entrepreneurs running several unrelated side businesses (easy ways to start your online business)

- Anyone who wants to save money instead of forming five separate traditional LLCs

Alabama said “YES” to Series LLCs in 2014. Only a few states do this.

In 2024, Alabama made the rules even better and clearer. Now the law says super loud: “Each little box stays safe from the others!” The protection is strong and easy to understand!

What Is a Professional LLC (PLLC) in Alabama?

A Professional LLC (we call it a PLLC) is for special jobs. If your job needs a state license, you must use a PLLC. That means:

- doctors

- dentists

- lawyers

- accountants

- builders (architects)

- engineers

- animal doctors

Only people who have that license can own the PLLC. The company can only do that one special job. Alabama Code Title 10A-5A (Series LLC law1

Big rule: If your company name has words like “law,” “medical,” or “dental,” the state says, “You must be a PLLC!” No regular LLC allowed.

Series LLC vs Professional LLC Alabama – Side-by-Side Comparison (2025 Rules)

| Feature | Series LLC | Professional LLC (PLLC) |

| Can it hold multiple unrelated businesses? | Yes – each series can be different | No – only one professional service |

| Required for doctors, lawyers, CPAs? | No – not allowed | Yes – required |

| Separate liability between series/cells? | Yes – if you follow the rules | No – only one company |

| Ownership restrictions | Anyone can own | Only licensed professionals |

| Filing fee with Alabama SOS (2025) | $200 (parent) + $100 per series (optional) | $200 + professional certification |

| Annual report fee | $100 (parent only) | $100 |

| Best for real estate investors? | Excellent | Not usually |

When a Series LLC Wins in Alabama (Real-Life Examples)

Here are easy real-life stories:

- Sarah and her rental houses: Sarah has eight houses she rents out. Normal way = pay $200 for each house = $1,600! Plus, pay every year for eight houses. Smart way = she makes one Series LLC for only $200. She puts each house in its own little box inside. If a renter sues one house, the other seven houses stay safe!

- Mike and his many jobs: Mike sells T-shirts online. He washes houses for money. He has two Airbnb houses. He uses one Series LLC. Only one tax number. Only one paper to send to the state each year. But each job still stays safe from the others’ proven strategies for sustainable business success

Save lots of money: Five normal LLCs = $1,000 now + $500 every year. One good Series LLC = pay way less money. You can save 70% or even 80%! More money stays in your pocket, hidden opportunities and risks for investors

Learn more about smart asset protection strategies for multiple holdings.

When You MUST Choose a Professional LLC in Alabama

- You are a physician opening a family practice

- You are an attorney starting a law firm

- You are a CPA firm with multiple accountants

- You are a dentist or veterinarian

Alabama law is crystal clear: Professional services must use a PLLC. You cannot use a Series LLC for these services even if you only have one office right now. UpCounsel Guide to Alabama Series LLCs2

If you try to put a doctor’s office or a law office inside a Series LLC, the state will say “NO!” and throw your papers away. You will lose all your safety. Someone can come take your house and car if you get sued. Use a PLLC for doctor and lawyer work. Keep it simple and stay safe!

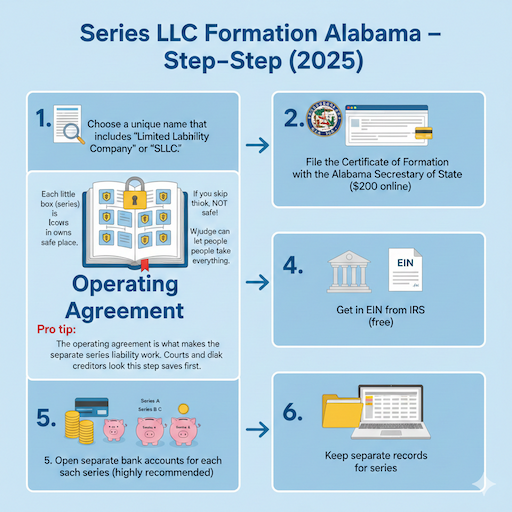

Series LLC Formation Alabama – Step-by-Step (2025)

- Choose a unique name that includes “Series Limited Liability Company” or “SLLC.”

- File the Certificate of Formation with the Alabama Secretary of State ($200 online)

- You must write a special rule book called the Operating Agreement. This book says: “Each little box (series) is its own safe place.” If you skip this book, the boxes are NOT safe! A judge can let people take everything. Write the book. Keep every series safe. This step saves you!

- Get an EIN from the IRS (free)

- Open separate bank accounts for each series (highly recommended)

- Keep separate records for each series

Pro tip: The operating agreement is what makes the separate series liability work. Courts and creditors look at this document first.

Professional LLC Formation Alabama – Step-by-Step (2025)

- Confirm your profession is on the approved list

- Get a letter or certificate from your licensing board (State Bar for lawyers, Medical Board for doctors, etc.)

- File Certificate of Formation + professional statement ($200 + extra certification fee)

- Draft a PLLC-specific Operating Agreement

- Register with your professional board if required

Tax Implications – Both Are Usually the Same

Both Series LLCs and PLLCs in Alabama pay taxes the easy way. The money the company makes goes straight to you. You pay tax on your own tax return. The company does not pay tax by itself.

For a Series LLC, the IRS says: “Send me one tax paper for the whole family.” You just add a little list that says how much money each little box (series) made or lost. Alabama Secretary of State – LLCs Overview3

Super simple! You only fill out one tax form. Talk to an Alabama CPA for your exact situation.

Common Myths in 2025 – Busted

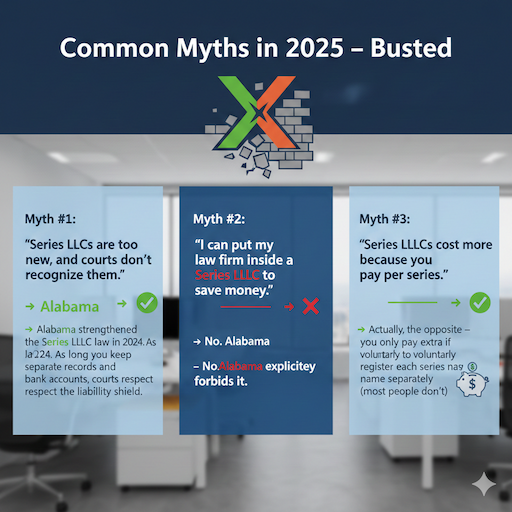

- Myth #1: “Series LLCs are too new, and courts don’t recognize them.” → Alabama strengthened the Series LLC Alabama law in 2024. As long as you keep separate records and bank accounts, courts respect the liability shield.

- Myth #2: “I can put my law firm inside a Series LLC to save money.” → No. Alabama explicitly forbids it.

- Myth #3: “Series LLCs cost more because you pay per series.” → Actually, the opposite – you only pay extra if you voluntarily register each series name separately (most people don’t).

Series LLC vs PLLC for Real Estate Investors in Alabama

Real estate wins big with Series LLCs. One investor we worked with saved $11,400 in the first five years by using a Series LLC for 12 properties instead of 12 separate LLCs.

If you are a licensed professional who also invests in real estate on the side, the most common strategy is:

- Form a PLLC for your medical/law practice

- Form a separate Series LLC (owned personally or through a holding company) for investment properties

- Never mix the two.

FAQ

Can a Series LLC own a Professional LLC in Alabama?

Yes, it can! Many doctors and lawyers do this. They make a Series LLC to hold houses or land. Then that Series LLC owns the Professional LLC, or the doctor’s office pays rent to the Series LLC. This keeps the doctor safe from the rental work. It is 100% okay with Alabama rules.

How much does a Series LLC cost in Alabama right now?

It costs $200 to start the main company. Every year, you pay $100 to the state. You can add as many series as you want for free inside your papers. You only pay more if you want to put each series name on the state website. Most people skip that and save money.

Do banks understand Series LLCs in Alabama yet?

Yes, they do now! Big banks like Regions and Wells Fargo say “no problem.” Credit unions do too. Just take your state papers, tax ID letter, and the big rule book (operating agreement) that shows each series. Call the bank first if you are not sure.

Is a Series LLC better than many single-member LLCs?

Yes, it is better and cheaper if you have three or more things (like houses or shops). You fill out one form. You pay the state only once a year. You use one tax number. But you must keep money and papers separate for each series. Do that part right, and you win big!

Conclusion

Ask yourself two quick questions:

Do I (or my business partners) provide a licensed professional service (medicine, law, accounting, engineering, etc.)? → If YES → You MUST form a Professional LLC (PLLC). No exceptions.

Do I own or plan to own multiple assets or run multiple unrelated businesses and want maximum flexibility + cost savings? → If YES, and you are NOT offering professional services → Choose an Alabama Series LLC.

Choosing the right structure today can save you thousands of dollars and countless headaches tomorrow.